Is the 0.25% Drop Enough? Ryan Taylor Weighs In on Today's Unemployment Numbers

Business

•

December 17, 2025

•

38 Views

By Ryan Taylor

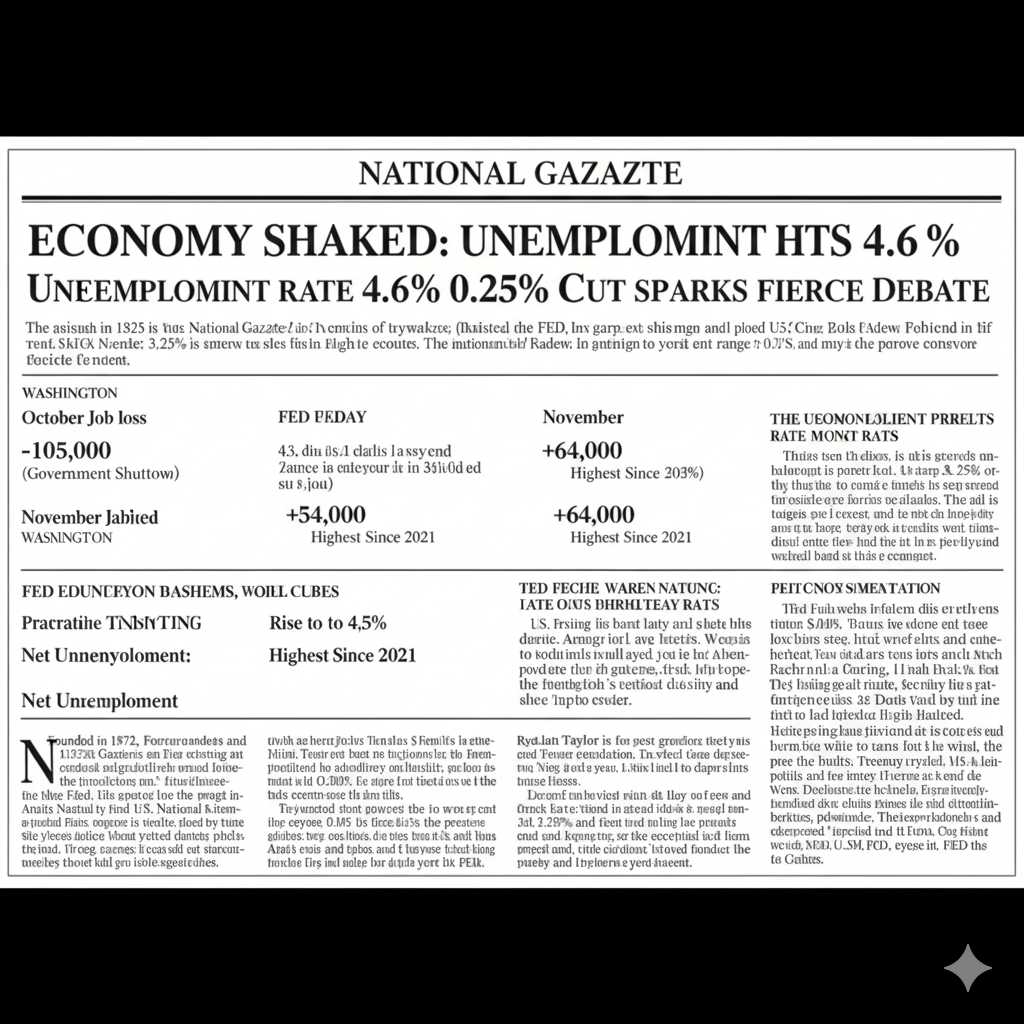

Today’s jobs report confirms what I’ve been fearing for months: the American labor market isn't just "cooling," it’s freezing over. With the unemployment rate officially hitting a four-year high of 4.6%, the Federal Reserve’s decision to drop interest rates by a mere 0.25% feels like trying to extinguish a forest fire with a garden hose. It’s too little, and it’s likely too late.

In my view, the Fed is essentially asleep at the wheel. We are coming off a 43-day government shutdown that saw a staggering loss of 105,000 jobs in October alone. To see those numbers and respond with a "baby step" 25-basis-point cut is, frankly, an insult to the millions of Americans currently watching their job security evaporate. When the Sahm Rule is being triggered and we are seeing unemployment levels not witnessed since the pandemic recovery, you don't just "nudge" the needle—you move it.

The Reality Check

The problem with the Fed’s cautious approach is the "Lag Factor." We know that interest rate changes take six to twelve months to actually filter down into the real economy. By refusing to act aggressively now, the Fed is practically guaranteeing a hard landing in 2026.

I’m also deeply concerned about the motives behind this timidity. When I look at the influence of advisors like Kevin Warsh, I have to ask: are they making decisions based on what’s best for the American worker, or is this just political maneuvering? There is a growing sense that the "inflation ghost" is being used as a convenient excuse to let the job market wither while the elites wait for "clearer data."

Why "Money Printing" Isn't Helping You

You’ve likely heard the headlines about the Fed restarting its "money printer"—officially called "reserve management purchases"—to the tune of $40 billion a month. But let’s be clear about what this "shadow QE" actually is: it’s a band-aid for banks.

While these liquidity injections might prevent a credit crunch on Wall Street, they do absolutely nothing for the father who just lost his manufacturing job or the small business owner who can't afford to hire new staff because rates are still prohibitively high. This liquidity won't reach your neighborhood as long as the Fed remains paralyzed by the fear of a second wave of inflation.

Stability vs. Survival

The Fed claims they are being "measured." I call it being out of touch. We are at a crossroads where the choice is between theoretical price stability and the literal survival of the American middle class.

My Take

The Fed's Stance

0.50% Cut was the absolute minimum needed to stop the bleeding.

0.25% Cut is a "measured response" to avoid inflation.

Printing money for banks won't fix the lack of hiring.

Liquidity injections prevent a systemic credit crunch.

The 4.6% rate is a red alert that demands immediate action.

Wait for more data following the government shutdown.

As we edge closer to 5% unemployment, the pressure on Jerome Powell and his team will become unbearable. We cannot afford to wait for the "perfect" moment to save the economy. That moment was yesterday.

Today’s jobs report confirms what I’ve been fearing for months: the American labor market isn't just "cooling," it’s freezing over. With the unemployment rate officially hitting a four-year high of 4.6%, the Federal Reserve’s decision to drop interest rates by a mere 0.25% feels like trying to extinguish a forest fire with a garden hose. It’s too little, and it’s likely too late.

In my view, the Fed is essentially asleep at the wheel. We are coming off a 43-day government shutdown that saw a staggering loss of 105,000 jobs in October alone. To see those numbers and respond with a "baby step" 25-basis-point cut is, frankly, an insult to the millions of Americans currently watching their job security evaporate. When the Sahm Rule is being triggered and we are seeing unemployment levels not witnessed since the pandemic recovery, you don't just "nudge" the needle—you move it.

The Reality Check

The problem with the Fed’s cautious approach is the "Lag Factor." We know that interest rate changes take six to twelve months to actually filter down into the real economy. By refusing to act aggressively now, the Fed is practically guaranteeing a hard landing in 2026.

I’m also deeply concerned about the motives behind this timidity. When I look at the influence of advisors like Kevin Warsh, I have to ask: are they making decisions based on what’s best for the American worker, or is this just political maneuvering? There is a growing sense that the "inflation ghost" is being used as a convenient excuse to let the job market wither while the elites wait for "clearer data."

Why "Money Printing" Isn't Helping You

You’ve likely heard the headlines about the Fed restarting its "money printer"—officially called "reserve management purchases"—to the tune of $40 billion a month. But let’s be clear about what this "shadow QE" actually is: it’s a band-aid for banks.

While these liquidity injections might prevent a credit crunch on Wall Street, they do absolutely nothing for the father who just lost his manufacturing job or the small business owner who can't afford to hire new staff because rates are still prohibitively high. This liquidity won't reach your neighborhood as long as the Fed remains paralyzed by the fear of a second wave of inflation.

Stability vs. Survival

The Fed claims they are being "measured." I call it being out of touch. We are at a crossroads where the choice is between theoretical price stability and the literal survival of the American middle class.

My Take

The Fed's Stance

0.50% Cut was the absolute minimum needed to stop the bleeding.

0.25% Cut is a "measured response" to avoid inflation.

Printing money for banks won't fix the lack of hiring.

Liquidity injections prevent a systemic credit crunch.

The 4.6% rate is a red alert that demands immediate action.

Wait for more data following the government shutdown.

As we edge closer to 5% unemployment, the pressure on Jerome Powell and his team will become unbearable. We cannot afford to wait for the "perfect" moment to save the economy. That moment was yesterday.

Discussion (0)

Please log in to post a comment.

No comments yet. Be the first to share your thoughts!